Let’s talk about the Wise Travel Card and why it’s the best option for most people traveling abroad. Get the best exchange rate, avoid problems with your bank, and budget effectively. In this Wise Travel Card review, we’ll go over whether Wise is right for you – and exactly how to get your card.

Table of contents

What is the Wise Travel Card?

The Wise Travel Card is a debit card connected to an online account. While Wise isn’t a banking institution, they essentially act like one. This means if you’re traveling (or even living) abroad, it makes your life so much easier.

That’s why the brand Wise (formerly TransferWise) is one of my favorite tools if you’re constantly traveling abroad.

As someone that travels and works internationally all the time – Wise has truly been a lifesaver for me.

The actual card can hold multiple currencies, all connected to different currency accounts. Thanks to this, they’re able to offer some of the best exchange rates, with hardly any fees whatsoever.

In other words – I never have to deal with Paypal’s insane international fees again.

Benefits of using the Wise Card

The Wise Card is pretty easy to sign up for and use. And while there are some other options out there (like Revolut), this is why I usually stick to Wise:

- Market Exchange Rates: The exchange rate is unbeatable, and they charge very small currency conversion fees.

- Multi-Currency Support: You can get access to around 50 currencies, which makes it super convenient if traveling to multiple countries.

- Low Fees: You get 2 free withdrawals per month, then it’s a fixed fee (not percentage) afterwards. To get the physical card, it costs around $9 (one-time fee).

- Convenient Mobile App: The app lets you pay contactless, move your money around, and even send to/from your normal bank.

- Instant Freezing/Unfreezing: If you lose your card, you can freeze the card instantly through the app. And if you want to keep it frozen when you’re not traveling, you can reactivate it instantly, too.

The only downside in my opinion is that sending invoices isn’t super intuitive, so my fellow freelancers might not want to use it as their only tool.

But if you’re a traveler, then I seriously can’t think of a better option!

How does the Wise Card work?

The actual Wise Card acts like a prepaid debit card. You transfer a certain amount of money from your normal bank into Wise, then you can switch it to whatever currency you’d like.

The transaction fees are super low (about 1.75% depending on the currency). This is usually much better than what your typically bank would offer. Especially since you’re working with the market exchange rate, it works out better.

When I used to use my American bank account in Spain, I was charged about 4-5% for each transaction, which adds up quickly.

So with Wise, you can just pay as if it were your normal card and enjoy saving money!

Plus, the fact that it’s only connected to your Wise account means you never have to worry about overdraft fees!

How to get the Wise Card

Applying for a Wise Card is super easy. It should take around 20 minutes to get everything set up. Although Wise does a “test” transfer to/from your normal bank account, which might take a couple days. This is just for normal verification purposes – so I recommend setting up Wise about a month before your trip!

1. Create a Wise Account

Sign up for a Wise account online.

You just follow the normal steps to add in your bank account details, clarify which currencies you need, and then verify your identity.

You have a primary account, but then you can also open “bank accounts” in whichever currency you need. These act as if they were normal banks in the country of choice, but they’re all easily visible and connected on your dashboard.

(Saying the word “account” so many times sounds complicated, but it really is super easy).

2. Apply for the card

Once you have your Wise debit account set up, apply for the physical Wise Card. You’ll have to add in some details about delivery and pay the one-time fee.

And don’t worry – the $9 fee will more than pay itself off if you plan on spending more than $100 when traveling.

You can also use a Wise Account without a physical card. For example, I have a normal Spanish bank account. So when my family wants to send me birthday money, they do it through Wise – and I can transfer it right to my normal account.

This way, the transfer rate is so much better for international money transfers.

So that’s an option if you want to stay abroad for the long-term, as well.

3. Add funds to your Wise Account

Once you get your card set up, you’ll have to transfer funds from your normal bank account. You can also use other sources like PayPal, etc.

I suggest only adding the amount you’re willing to spend on vacation. This way, you’re budgeting correctly, don’t have to worry about overspending, and you don’t have to worry if you lose your card. So I much prefer the Wise Debit Card over any credit cards for this reason.

And if you do want to spend more – you can just transfer money over whenever you need it, too.

Pro Tip: You can also send money to your account or a friend’s easily. This makes it easy to move money around if you need to.

4. Pay with the card or the app

As you’re traveling, just use your card as you would any other debit card. This is why I like the Wise Travel Card so much – it makes the whole process simple.

And since the Wise App functions as if it were a local bank, you don’t need to worry about foreign transaction fees!

How to Use the Wise Card when Traveling

When using the Wise Card during your travels, follow these tips to make the most out of it:

Always Use the Local Currency

You’re already getting a good currency conversion rate from Wise, so make sure to use the local currency.

For example, if you pay in Spain, it’ll sometimes ask if you want to pay in Euros or US Dollars.

Always choose Euros (in this case). That will make sure you’re taking money out of your Euros Wise account.

This gives you the best exchange rate.

Use the Digital Card When Possible

In general, digital cards tend to have more advanced security than physical cards.

So if you’re a cautious traveler – take advantage of the digital card via the app.

If I’m being completely honest, I don’t usually take advantage of this. I’m always worried about my phone battery when traveling, so I typically just use the physical card instead.

But it’s true that I probably should use the digital card instead 🙈

It’s safer, helps you travel lighter, and is just as easy to activate/reactivate.

Withdraw Cash

You can use the Wise Travel Card like a debit card to pull out cash at an ATM. You can do this twice a month without any fees.

When traveling, I always like to have a little bit of cash on hand, just in case. You never know if that hole-in-the-wall bar is going to accept cards or not.

Sometimes the actual ATM will charge you a fee. So I recommend going to one that’s associated with a bank within the city you’re in. Try to avoid airport/touristy ATMs, as they almost always charge a traveler’s fee.

Only Keep the Amount You Need

One of the biggest risks tourists face is getting robbed (or just plain losing your phone & wallet).

And while there are lots of things you can do to stay safe, it’s better to stay prepared.

So I recommend only keeping the amount of money you actually need on this prepaid travel card. It’s easy to top up later on, but I prefer to keep only a moderate travel budget on the card at any time.

Do You Need a Wise Travel Card?

The Wise Travel Card is honestly such a great option – but not everyone needs it.

If you know that your bank offers incredibly competitive exchange rates or they don’t charge any international withdrawal fees – then maybe it’s not worth it for you.

This certainly wasn’t my case, but I don’t know the specifics for every bank in the world!

But I will say that for the majority of travelers, the Wise Card is a great option. Especially if you’re someone who travels to several countries or plans to live abroad for extended periods (looking at you, my digital nomad friends).

The exchange rates are great, the fees are very reasonable, and the user-friendliness takes out all the complications.

So you might not NEED the card, but I highly recommend it. Especially if you want to save money and make your travel experience less complicated.

Final Thoughts on the Wise Debit Card Review

Overall, I think the Wise Card is worth it for most travelers. So if you want a simple and economical way to handle international money transfers, payments abroad, and travel money – this is the way to do it.

You can get your Wise Travel Card here ⬇️

And if you need any other support for your travel resources, then make sure to reach out. I’m always happy to help a fellow traveler!

FAQs

There is a one-time fee (around $10) to obtain your Wise Card. However, there are no subscription fees, and the great exchange rate basically pays for itself!

Definitely! Wise has several security measures to make it a safe option, even for international travel. You can use the digital card for advanced security measures.

Yes, you can use the Wise Travel Card in the US. You can also use it for normal transfers, as well.,

Simply swipe, insert, or tap your Wise Card at payment terminals abroad, and select the local currency for transactions to avoid additional fees.

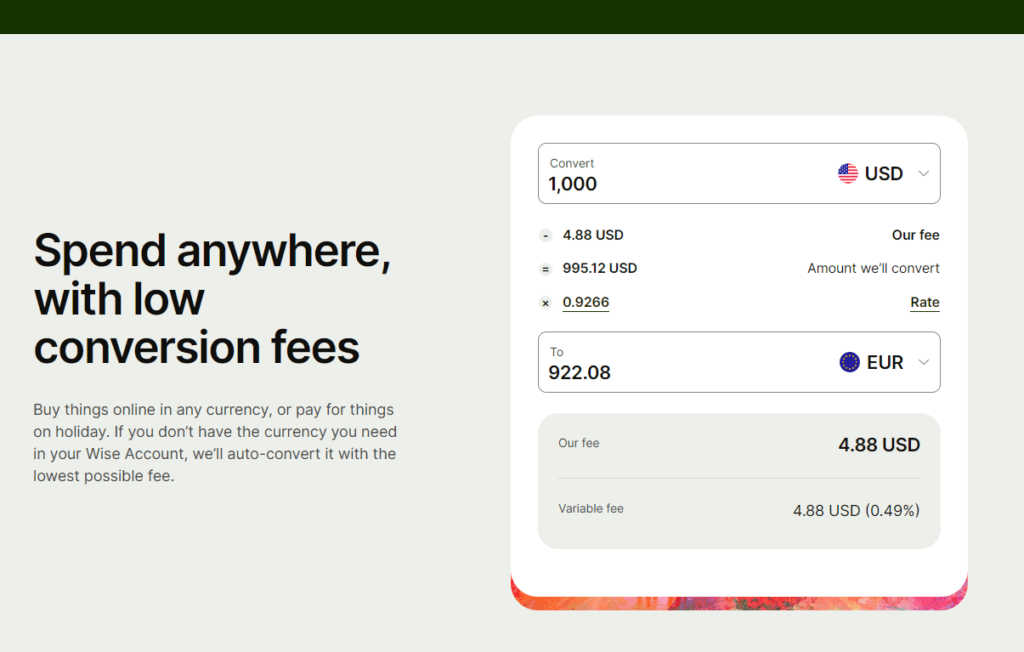

It depends on the currency. As of writing, the transfer fee for USD to EUR is 0.49%. So if you transferred 1000 USD to Euros, they’ll take $4.88 as their fee.

You get 2 free ATM withdrawals per month. After that, they charge a fixed fee.

If you’re frequently traveling abroad, I think it’s worth it. You don’t need to worry about exchange rates this way.

Need help planning your trip to Valencia?

Here are the tools I use for the cheapest (and most reliable) vacation planning:

- 🏠Booking – Affordable hotels and apartments

- 🏠Hostel World – Safe and budget-friendly hostels

- ✈️Skyscanner – My favorite tool for cheap flights

- 🚗Discover Cars – Best place for car rentals

- 🚄Trainline – The easiest way to book local trains in advance

- 📶Airalo – eSim cards for easy internet access while traveling

- 🦺Safety Wing – The #1 travel medical insurance

- 💸Airhelp – Cancelled flight compensation (it’s free!)

- 💱Wise – Easiest low-fee way to transfer currency

- 🗂️ Your Spanish Visa – Move to Spain the easy way

Affiliate disclosure: This post may contain affiliate links. These are links to services I personally recommend using for your trip to Valencia. At no extra cost to you, I may earn a small commission from these brands if you choose to make a purchase. Your support helps me pay my bills and eat more bunyols!